– From Classroom to Career

Client: National Youth Council, Singapore (under the National Youth Fund)

Challenge:

Transitioning into the workforce, many young adults struggle to manage their finances. By and large, traditional schooling often does not equip them with the skills needed to navigate real-world financial challenges. Without the right knowledge and habits, they risk falling into debt, struggling with day-to-day expenses, and missing opportunities for long-term stability and growth. Empowering financial capabilities in young adults is henceforth essential to helping them make informed decisions, build resilience, and take control of their financial future. However, this is often challenging due to limited comprehension, especially for those with language barriers. Furthermore, misconceptions about financial literacy being overwhelming or boring also exist, adding to youths’ fear and resistance towards the subject. Additionally, many youths struggle as they believe in a “right” way to manage finances, lacking the confidence to trust their own judgment.

Our Solution:

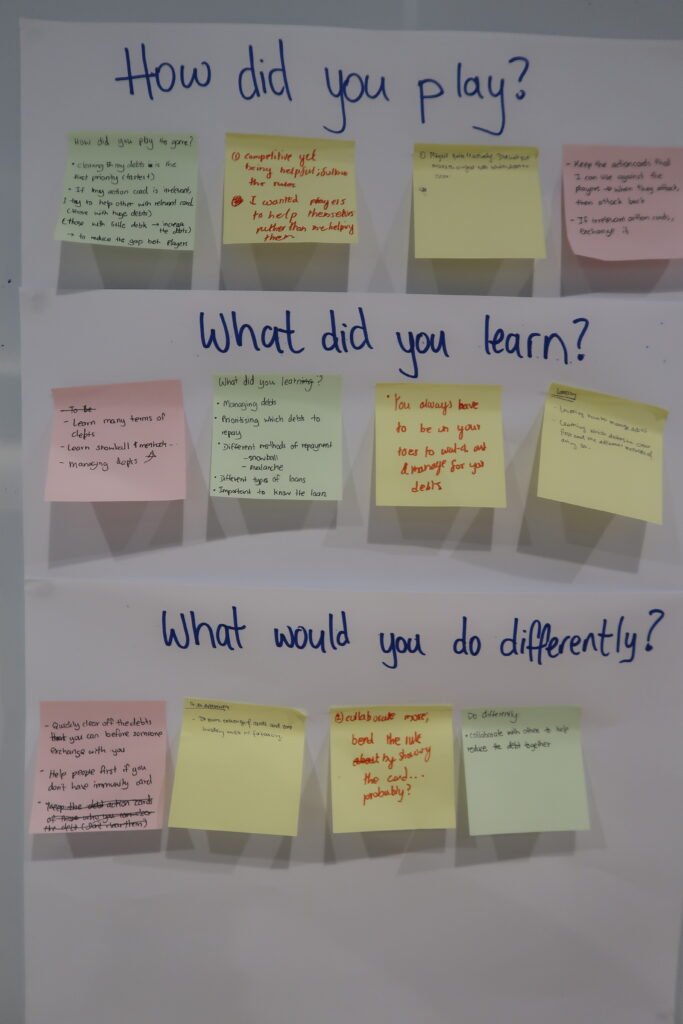

Delivered as a two-day, five-hour in-person workshop, we guided participants in exploring their personal relationship with money alongside key financial topics like debt, insurance and investments. In order to make learning engaging and approachable, we developed custom-designed board games that were used during the sessions. Subsequently, participants reflected on their decisions during gameplay, reinforcing the link between financial concepts and real-life application. By blending game-based learning with discovery learning, reflective questioning and self-assessment, we equipped participants with a foundational understanding of these essential financial concepts.

Moreover to track participants’ progress, we conducted pre- and post- workshop surveys to assess changes in confidence and understanding of the topics. Additionally, a follow-up focus group was held two months later to check in on participants’ continued development of their financial capabilities.

Impact:

In summary, the training reached 41 youths. Specifically, these include public participants, ITE students through our partnership with YMCA, and young abused mothers from a crisis shelter.

Markedly, post-workshop surveys showed a noticeable increase in confidence and financial management skills across all indicators. Evidently, this demonstrated the program’s positive impact. In detail, one participant took over managing her insurance policy from her parents. While another felt empowered, helping her father manage debts and assisting her mother in setting up a savings plan. Moreover, several participants also shared that they had started reading investment books, no longer feeling intimidated by the material and gaining the confidence to research unfamiliar financial terms.

Next Steps:

All in all, this project has affirmed our belief that financial literacy is insufficient for youths. Comparatively, financial education programs must include tools for behaviour change in order to be effective. After empowering youths to recognize that they have habits and preferences that needs to be considered, soft skills like questioning and looking for information etc. have to be developed. As a result, these empower youths to be more confident and ready for content-focused education.

Accordingly, a key component of this is to focus on creating beginner programs that focus on appealing to youths for learning through play and discussions, aiming to develop their capabilities rather than knowledge. This foundation methodology is preferred over beginning with lectures that will further affirm youths’ belief that finance is boring and difficult. Consequently, youths can then be progressed onto self-directed learning with guided coaching for more in-depth learning of specific topics such as the various types of investments, tax and retirement planning

Testimonials:

Interested to explore how Empower2Free can partner with you to bring impactful financial empowerment workshops like this to the young people in your school or organisation? Designed to equip participants with practical money management skills that boost their confidence, our workshops supports their journey of transition into adulthood and can cover a wide range of financial topics depending on your needs. Contact us here